XRP Price Prediction: Navigating Consolidation Amidst Mixed Signals

#XRP

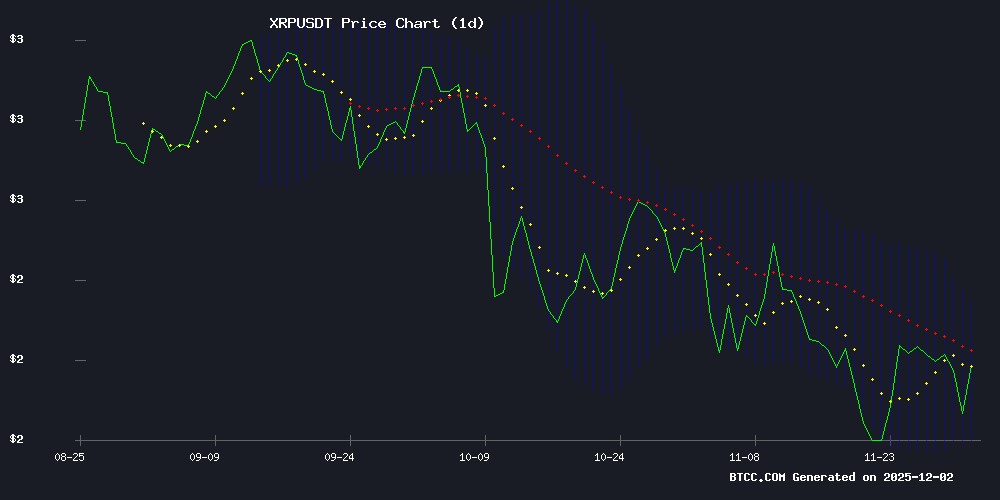

- Technical Consolidation: XRP is trading below its key 20-day moving average with a bearish MACD, indicating a phase of consolidation with immediate resistance at 2.1455 USDT.

- Mixed On-Chain Signals: A significant drop in whale wallets contrasts with a surge in network payments and suspected institutional activity, creating a complex fundamental backdrop.

- Path to Higher Prices: A sustained break above the 20-day MA, coupled with stabilizing whale supply and continued network growth, is needed to challenge the next major resistance near 2.35 USDT.

XRP Price Prediction

Technical Analysis: XRP Shows Consolidation Below Key Moving Average

As of December 2, 2025, XRP is trading at 2.0307 USDT, positioned below its 20-day moving average of 2.1455. This suggests near-term bearish pressure. The MACD indicator, with a value of -0.0187, confirms a bearish crossover as the signal line (0.1033) remains above the MACD line (0.0846). However, the price is currently trading above the lower Bollinger Band (1.9371), indicating potential support. 'The convergence NEAR the lower band, coupled with the negative MACD, points to a period of consolidation,' says Robert, a financial analyst at BTCC. 'A sustained break above the 20-day MA could signal a shift in momentum.'

Market Sentiment: Whale Exodus Meets Surging Network Activity

Recent on-chain data presents a mixed sentiment picture for XRP. A significant 20.6% decline in whale wallets suggests large holders are consolidating or distributing supply, which can be a near-term headwind for price. Conversely, a surge in payments on the XRP Ledger and suspected institutional transaction activity point to robust underlying network utility. 'The dichotomy between whale wallet reduction and increased ledger activity creates a complex sentiment backdrop,' notes BTCC financial analyst Robert. 'While supply consolidation from large players may cap rallies, rising fundamental usage could provide a firmer long-term floor.' This aligns with the technical view of near-term consolidation.

Factors Influencing XRP's Price

XRP Whale Wallets Decline 20.6% Amid Supply Consolidation

The number of XRP wallets holding over 100 million tokens has plummeted by 20.6% in just eight weeks, marking one of the fastest contractions ever recorded for this tier. According to Santiment data, 569 large accounts have dissolved since late September, yet the remaining whales now collectively hold 48 billion XRP—a level unseen since 2018.

This paradoxical trend reveals deepening supply consolidation. While whale counts dwindled from over 2,700 during July's $3.65 all-time high to below 2,000 today, their aggregate holdings grew by 300 million XRP. The ledger shows sharks and whales absorbing sell-side pressure, with accumulation patterns mirroring late-cycle bear markets.

Price action tells a parallel story. As XRP retreated from its $2.85 November peak, large holders appear to be positioning for the next cycle. Such supply shocks historically precede volatility—whether such accumulation foreshadows a breakout or distribution remains the market's unanswered question.

Phantom XRP Transactions: Institutional Activity Suspected on XRP Ledger

The XRP Ledger has witnessed an anomalous surge in activity, with over 40,000 AccountSet transactions appearing abruptly. These transactions, unrelated to payments or trading, suggest large-scale wallet configuration—a hallmark of institutional preparation.

Analysts note the pattern mirrors custodial setups: segregated accounts, multi-signature controls, and compliance-ready metadata. The scale implies a coordinated effort, possibly by a financial entity or exchange building infrastructure for future operations.

XRP Ledger Sees Surge in Payments Amid Price Volatility

The XRP Ledger processed over 1.05 million payments between unique wallets in a single day, marking a 15% overnight spike and a 200,000-transaction increase from earlier in the week. This surge in on-chain activity coincides with growing speculation about institutional interest, potentially linked to the rollout of XRP-related ETFs in the U.S. market.

Despite the network's usage spike, XRP's price dropped 6.7% to $2.04, with trading volumes doubling to $4 billion. The token now tests critical support at $1.90—a level that held in late November amid shifting Fed policy expectations. A breakdown could trigger a steeper correction toward $1.65.

The divergence between ledger activity and price action raises questions: Is this payment volume a precursor to institutional adoption or merely whale movements? Market participants watch for either a confirmation of demand or further downside.

How High Will XRP Price Go?

Based on the current technical setup and market news, XRP is in a consolidation phase with a cautious near-term outlook. The immediate resistance is the 20-day Moving Average at 2.1455 USDT, with stronger resistance at the upper Bollinger Band near 2.3539. A decisive break and close above the 20-day MA could open a path toward testing the 2.35 level.

The following table summarizes key technical levels:

| Level | Price (USDT) | Significance |

|---|---|---|

| Current Price | 2.0307 | Base Level |

| Lower Bollinger Band | ~1.9371 | Near-term Support |

| 20-Day Moving Average | 2.1455 | Key Resistance / Trend Indicator |

| Upper Bollinger Band | ~2.3539 | Next Major Resistance |

Fundamentally, the decline in whale wallets indicates potential selling pressure or profit-taking from large holders, which may limit upside in the short term. However, the surge in XRP Ledger payments and suspected institutional activity are strong positive long-term drivers. Analyst Robert from BTCC suggests that for a sustained move higher, XRP needs to overcome the technical resistance around 2.15 and see the whale supply dynamics stabilize. The convergence of positive network growth and a technical breakout would be the most bullish scenario for a push toward the 2.35 region and beyond.